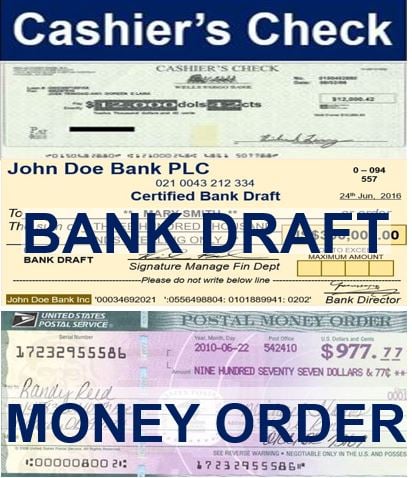

money order vs bank draft

When you ask to purchase a bank draft the funds are immediately withdrawn from your deposit account. A money order gives anyone the power to move cash around without the use of a bank account.

|

| Difference Between Bank Draft And Money Order Difference Between |

Canada Post charges 750 per money order.

. On the other hand in the case of a bank draft. The total fees can be tens of dollarsmore than other forms of electronic money transfers. At age 34 Janell Tryon owes 250000 in student debt. 3 rows The main difference between Money Order and Bank Draft is that a Money Order is a payment.

How bank drafts work. What is a Bank Draft. Money orders are cheaper than bank drafts. Generally money orders range between 2 and 7.

Money orders are arguably safer than checks because they dont have the payers account and routing number printed on the bottom. For a money order you prepay the specific amount which reserves the funds until the money order is cashed. Bank draft Scotiabank we will focus on money orders. Occasionally the recipient may have to pay a small fee to cash the money order.

A money order is a check guaranteed by the bank that issued it. This type of check may be used when a personal check is not allowed. This way the personbusiness receiving payment wont have problems with bounced cheques etc. With larger payments a draft is a valid way to send funds securely.

As the purchaser of the bank draft you are responsible for delivering the bank draft to the payee. The account holder is the drawer of the cheque. Money orders are available only to TD Bank customers and are subject to a fee. Differences between Bank draft and Money order Definition.

Pay order also called Bankers Cheque is a type of payment which gets cleared in the same branch of the bank which issued it where demand drafts are a mode of payment which gets cleared in any branch of the issuing bank. Bank drafts and money orders are more secure way of payment compared to personal or business cheques because they require that the amount specified on them is pre-paid. For more information or to request a money order from TD Bank. Where a financial institution offers both products money orders will always be more affordable.

For example if the purchase amount is under 1000 it might be considered a money order while anything above that amount requires purchasing a bank draft. The key difference is that a certified cheque is used by its customers to pay for goods and services and a bank draft is an instrument one can use for the same except that bank provides it. That makes them a useful tool for people who cant get a bank account. Difference Between Postal Order and Money Order and Cheque.

Once you send the order your financial institution freezes an amount from your account. All major Canadian banks issue both. You can only purchase bank drafts from a bank while money orders can be purchased from certified stores post offices or banks. Most money order providers charge a nominal feeranging from less than a dollar to around 10.

Money orders also have fees but theyre often less than wire transfers. As we have already discussed certified cheque vs. A Bank Draft is a physical means of providing payment to a third party. A bank issues and certifies a certified check by placing a hold on the funds until the check is presented for cashing.

The maximum amount allowed on a TD Bank money order is 100000. However it needs to be prepaid. These funds are put into the banks reserve account until the bank draft is presented for payment. It means that you dont need to have a bank account to get a money order.

You can get a money order at the post office as the payment is guaranteed by Canada Post. 3 rows The main difference between Money Order and Bank Draft is that a Money Order is a payment. The key differences are as follows. Funds are immediately taken from your RBC bank account in exchange for the draft guaranteeing the funds for the recipient.

A bank draft refers to a payment made on behalf of the payer and guaranteed by the issuing bank. In pay order it is pre-printed that this instrument is non-negotiable whereas demand draft is a type of negotiable instrument. Only a bank may issue a bank draft while an approved institution. Bank drafts can be used to make a payment to a third party both in Canada and abroad 1 and are available for a fee of 850 each.

She only took out 150000 of it 100000 for an undergraduate degree at New York University and 50000 for a. Bank draft fees are higher than money order fees approximately 10 at any of Canadas big banks. While in a bank draft a check is made to the payee after accepting the money from the issuers account a money. Both money orders and bank drafts are used to pay money to a third party.

Bank Drafts Some financial institutions refer to money orders as bank drafts while others differentiate between the two usually based on the cheque amount. Money Order Advantages. Money Orders vs. A money order allows you to transfer funds up to 99999.

|

| Difference Between Bank Draft And Money Order Difference Between |

|

| Bank Draft Definition And Meaning Market Business News |

|

| Bank Draft Vs Certified Cheque Key Top 8 Differences |

|

| Difference Between Bank Draft And Money Order Difference Between |

|

| Bank Draft Vs Certified Cheque Top 5 Best Differences With Infographics |

Posting Komentar untuk "money order vs bank draft"